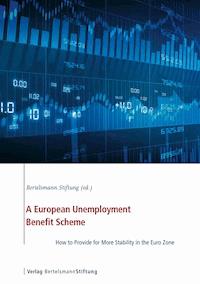

A European Unemployment Benefit Scheme ebook

Uzyskaj dostęp do tej i ponad 250000 książek od 14,99 zł miesięcznie

- Wydawca: Bertelsmann Stiftung

- Kategoria: Biznes, rozwój, prawo•Biznes, rozwój

- Język: angielski

The recent euro crisis and the dramatic increase of unemployment in some euro countries have triggered a renewed interest in a fiscal capacity for the European Union to stabilize the economy of its member states. One of the proposed instruments is a common European unemployment insurance. In this book Sebastian Dullien from the HTW Berlin provides and evaluates a blueprint for such a scheme. Building on lessons from the unemployment insurance in the United States of America, he outlines how a European unemployment benefit scheme could be constructed to provide significant stabilization to national business cycles, yet without strongly extending social protection in Europe. Macroeconomic stabilization effects and payment flows between countries are simulated and options, potential pitfalls and existing concerns discussed.

Ebooka przeczytasz w aplikacjach Legimi na:

Liczba stron: 194

Rok wydania: 2014

Odsłuch ebooka (TTS) dostepny w abonamencie „ebooki+audiobooki bez limitu” w aplikacjach Legimi na: